e-Tax Invoice & e-Receipt of Revenue Department Preparation Service

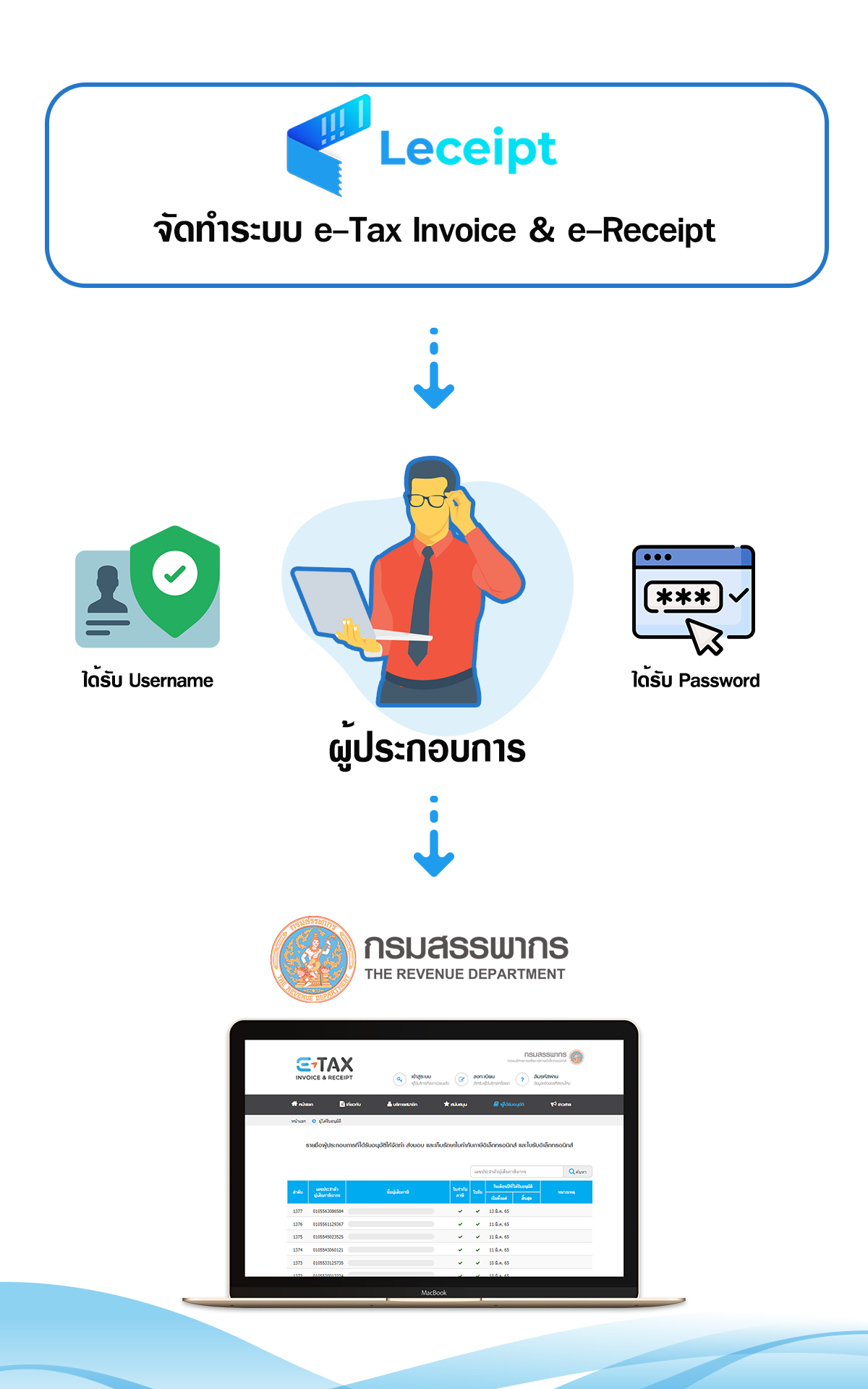

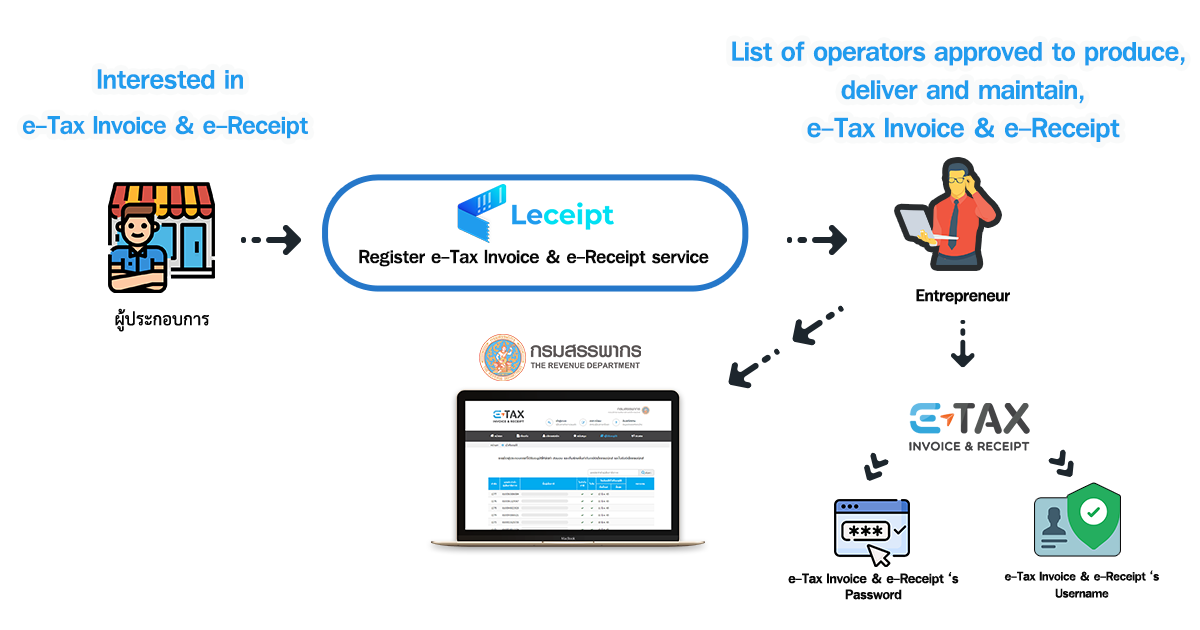

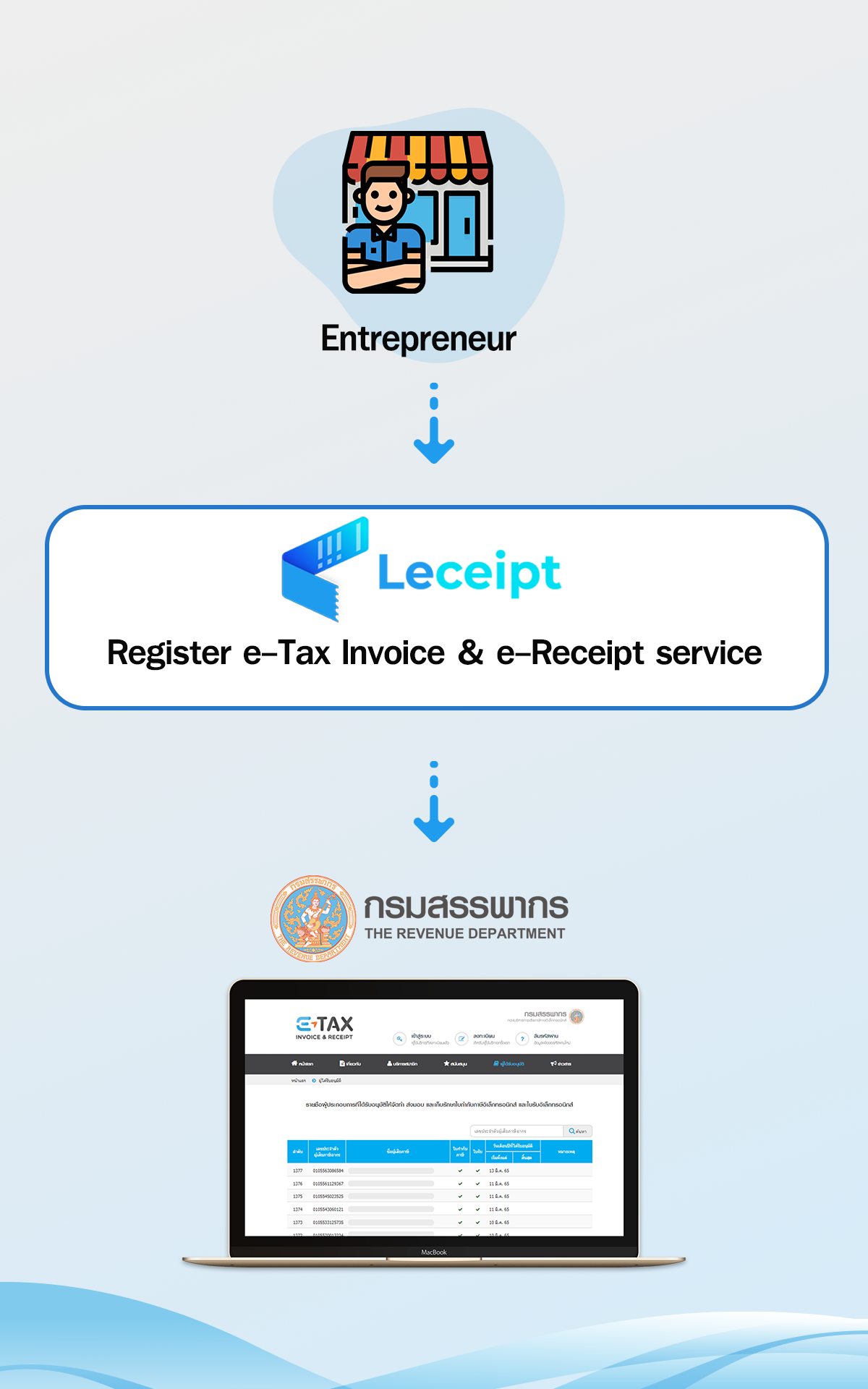

For entrepreneurs who need to bring their business into the e-Tax Invoice & e-Receipt system, which Leceipt offers to operators, there are things that are received: Approval for entering the e-Tax Invoice & e-Receipt system on the website of the Revenue Department and the Username and Password of the e-Tax Invoice & e-Receipt system

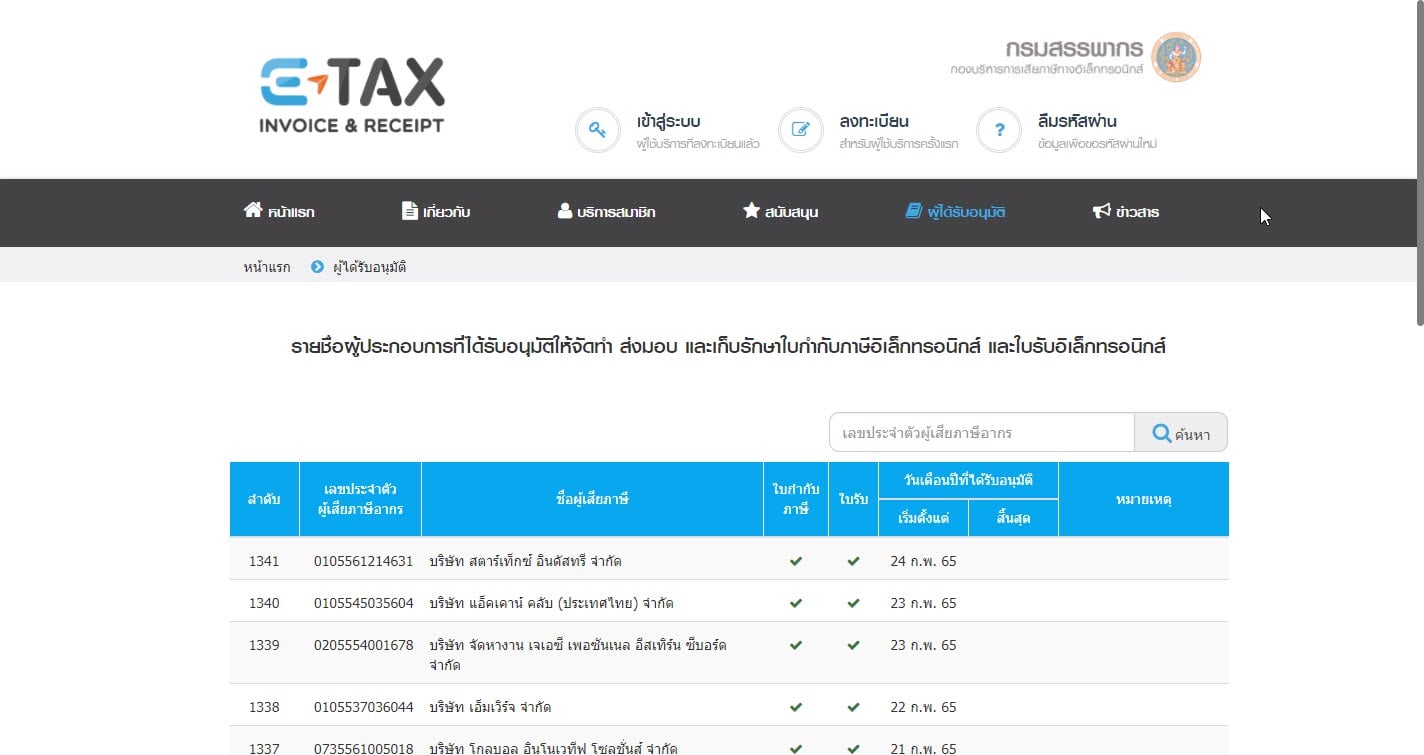

1. Having the name approved to enter the e-Tax Invoice & e-Receipt system on the website of the Revenue Department

By the way, Leceipt will be the operator whether from small entrepreneurs to companies who want to be approved into the e-Tax Invoice & e-Receipt system without having to worry about using the software or program to be complicated, which is convenient do not have to do it yourself Reduce difficult mosquitoes and save time.

Example of a company entering the e-Tax Invoice & e-Receipt system of the Revenue Department which these operators are authorized to produce, deliver and maintain electronic tax invoices and electronic receipts

2. Have a username and password of the e-Tax Invoice & e-Receipt system of the Revenue Department

In addition, you will receive a Username and Password that can access the system of the e-Tax Invoice & e-Receipt system on the website of the Revenue Department as well.