How to genearte a Withholding Tax Certificate.

This section we will describe how to genearte the Withholding Tax Certificate.

The withholding tax certificate document is a document that the income earner will receive to show that the payee has been withholding tax already.

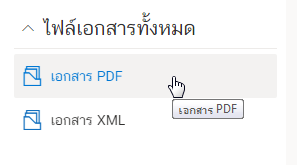

1. Accessing the page “Withholding Tax Certificate”.

First, go to the topic “Withholding Tax Certificate”, which is in the menu bar on the left hand side as in the picture.

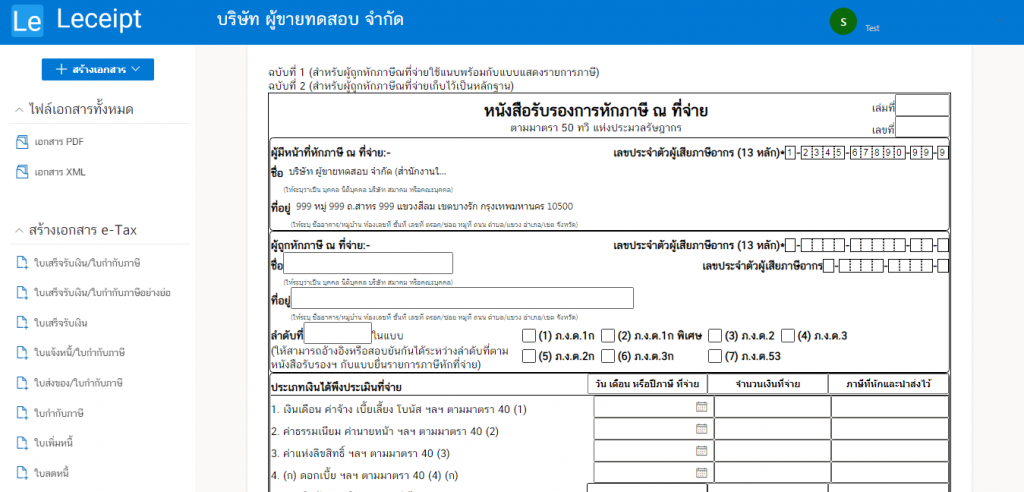

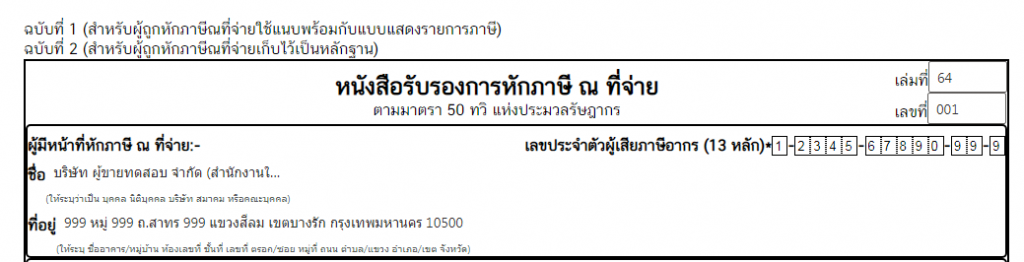

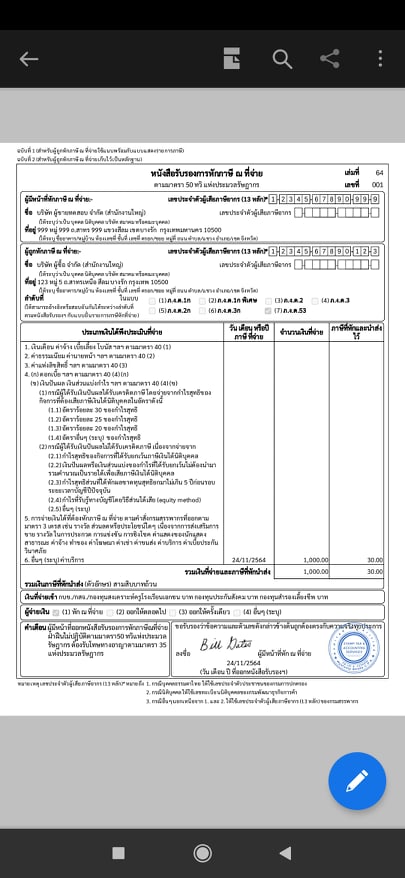

Then it will go into the form of creating a document for withholding tax certificate as shown in the picture.

2. Generating a “Withholding Tax Certificate”.

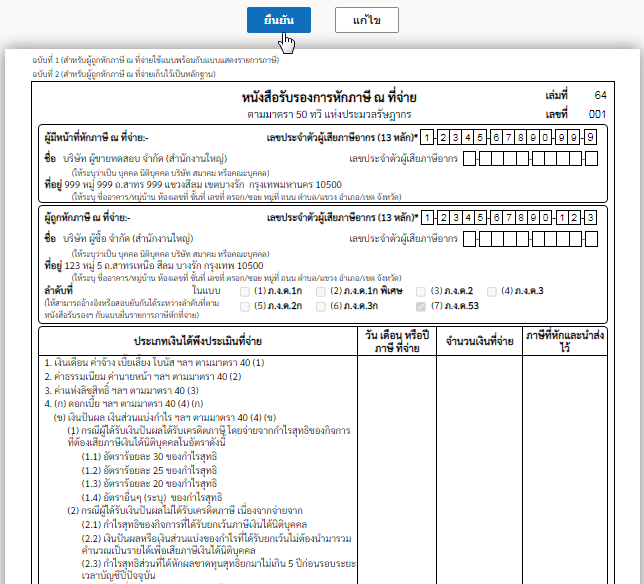

Fill in the part that is เล่มที่ and เลขที่ as below.

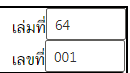

Fill in the details. By filling in the following information

ชื่อ (Name)ที่อยู่ (Address)เลขประจำตัวผู้เสียภาษีอากร (13 หลัก) (Taxpayer Identification No. )

And please select the (7)ภ.ง.ด.53 as below.

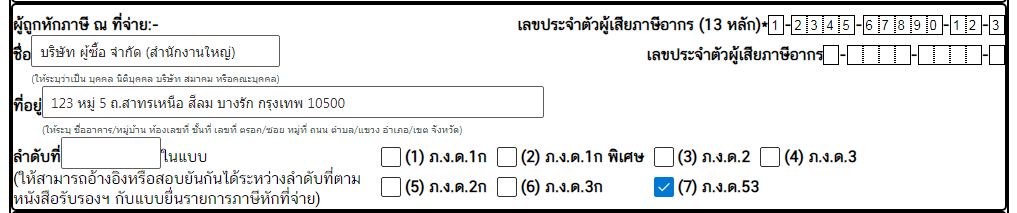

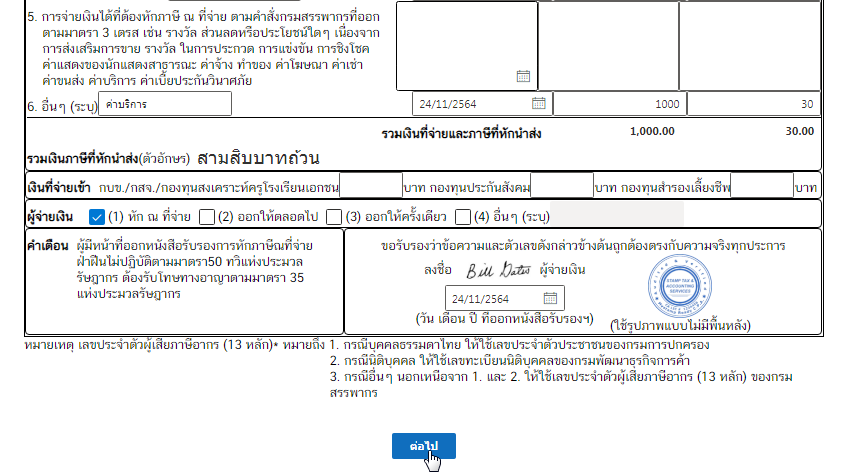

In the section, ประเภทเงินได้พึงประเมินที่จ่าย (Type of Assessable Income) enter วัน เดือน ปี ภาษีที่จ่าย (Date of Tax Paid) จำนวนเงินที่จ่าย (Amount Paid)

ภาษีที่หักและนำส่งไว้ (Taxes Withheld and Remitted) according to the desired topic. In the example, it will be item 6. Others with details included. (In here, put as “service fees”) as shown in the picture.

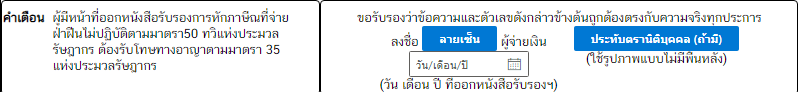

Next, on the topic ผู้จ่ายเงิน (Payer), select(1) หัก ณ ที่จ่าย (Withholding)

ประทับตรานิติบุคคล (ถ้ามี) -- (stamp image) and select “date, month, year of issuing the certificate”.

We recommended to remove the background. You can see how to delete it by clicking on the How to remove stamp background.

>When everything is fine, click the ต่อไป (Next) button.

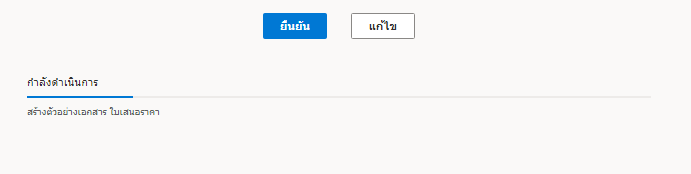

Then the system will process the process to wait a moment as shown in the picture.

Please select the ยืนยัน (Confirm) to generate document.

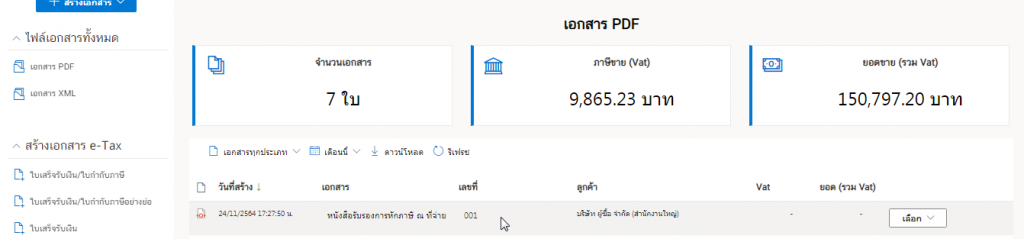

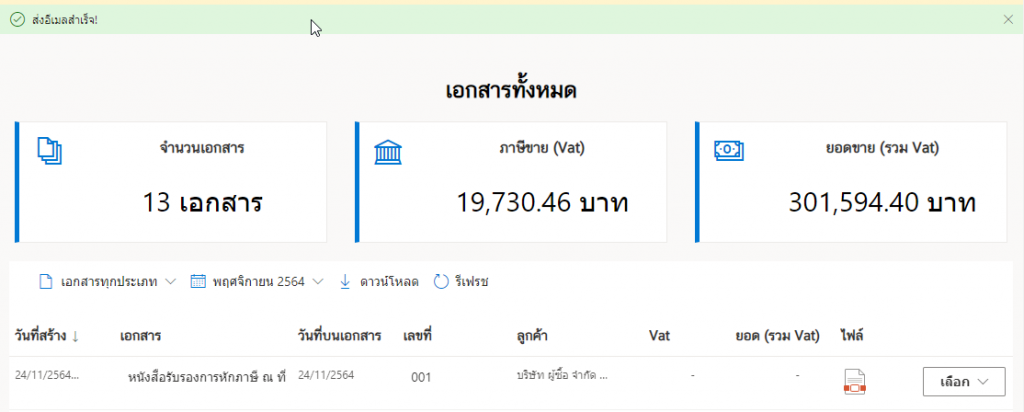

3. Completed document.

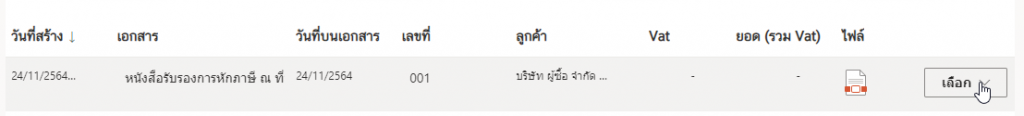

Then we will get a file of the completed document as shown in the picture.

4. Openning the document.

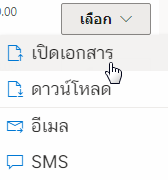

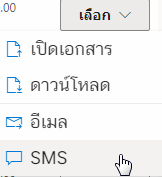

At the เลือก (Select), and then click the เปิดเอกสาร (Open).

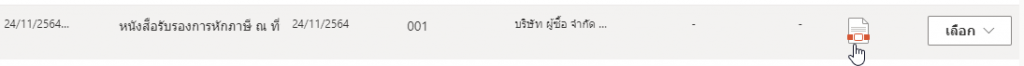

Or click on the PDF icon.

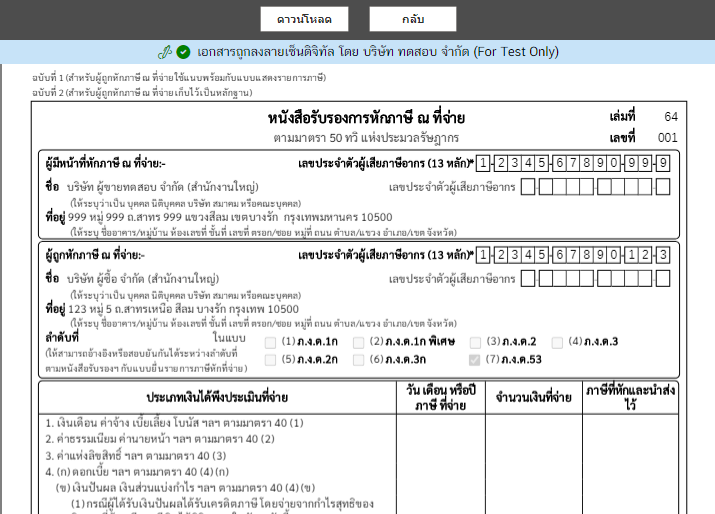

After that as below.

5.Downloading.

From the menu เลือก (Select) and click ดาวน์โหลด (Download) system will download the file.

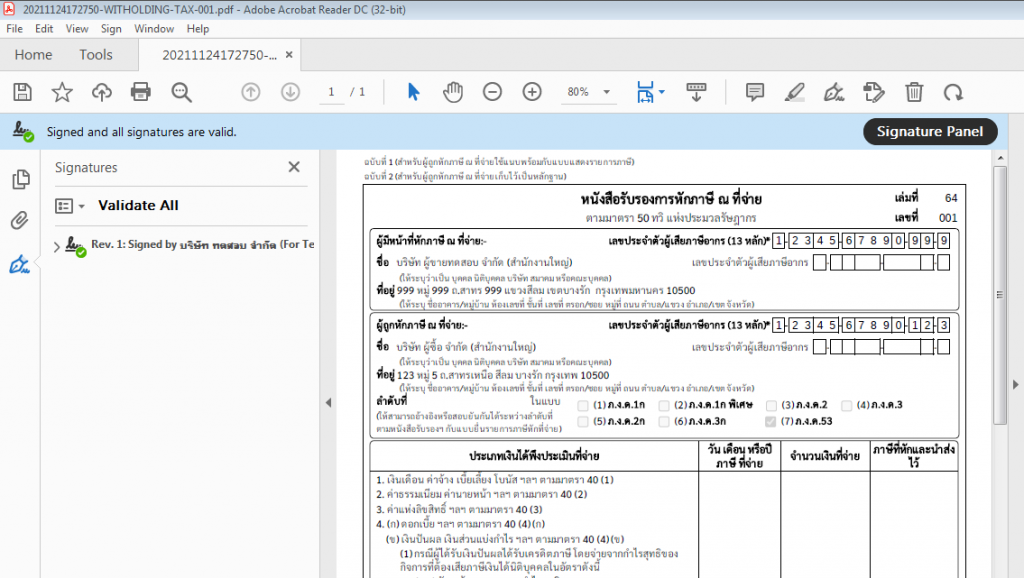

And when you open the file (Adobe Acrobat Reader DC is recommended) you’ll see the digitally signed document.

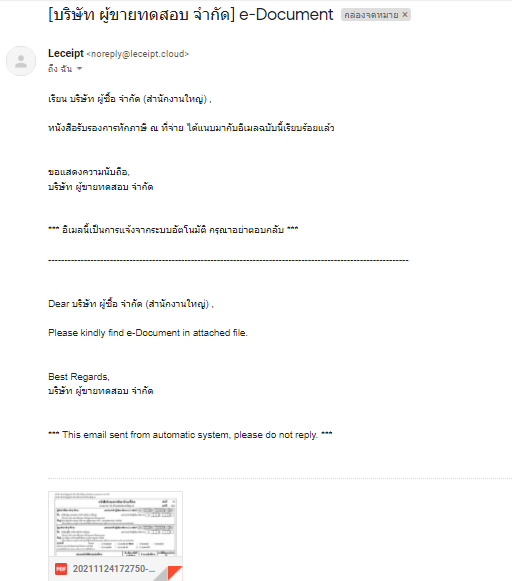

6. Emailing.

We will describe as following.

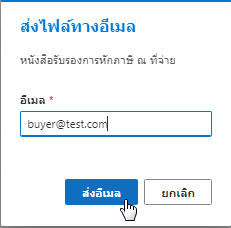

Then, in a pop-up box, enter the email address you want to send the file, And click on ส่งอีเมล (Send Email).

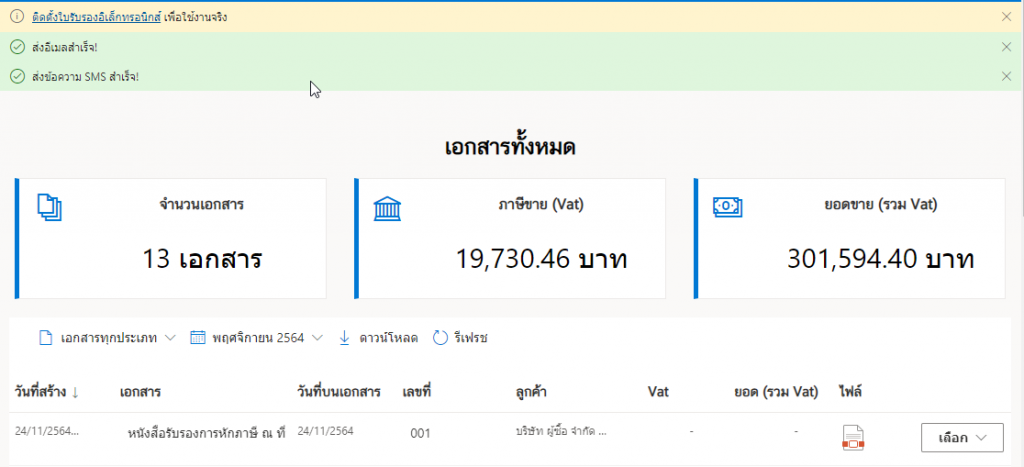

When the file has been sent to the destination email successfully. The system will prompt as ส่งอีเมลสำเร็จ (Email sent!).

When the recipient has opened the e-mail containing the file will be displayed in the form as shown in the figure.

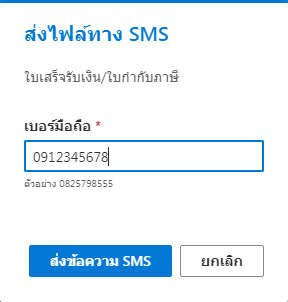

7. Send SMS.

>Our system can also send the file via SMS. At เลือก (Select) and click on SMS.

Then the system will pop-up, enter the mobile phone number of the number you want to send, then click ส่งข้อความ SMS (Send SMS).

Once the SMS has been sent successfully, a message will appear ส่งข้อความ SMS สำเร็จ! (The SMS sent!).

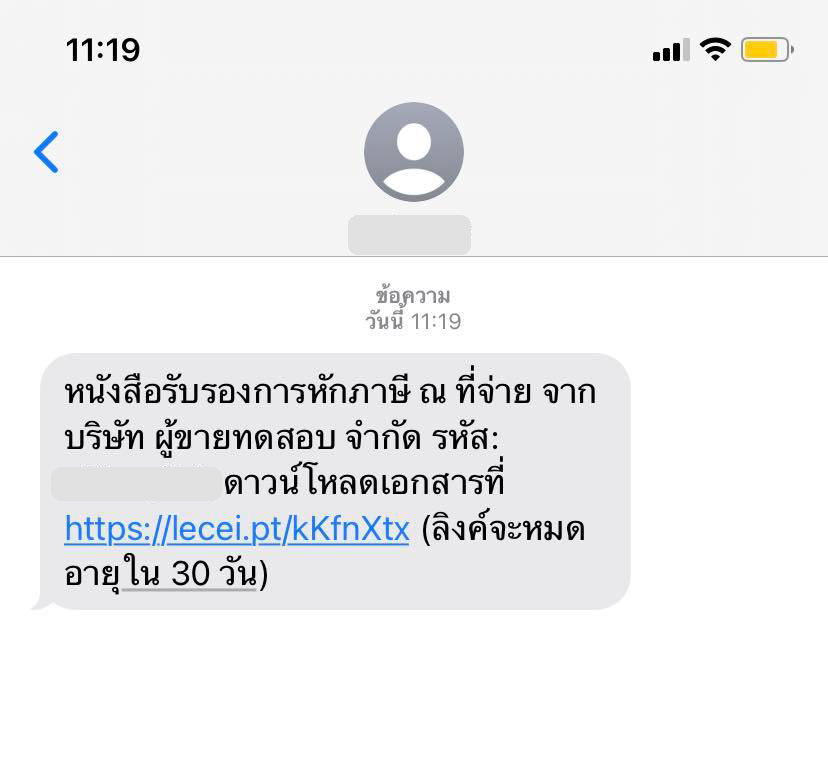

Let’s look at the part of the destination of the person receiving the SMS. When opening the mobile phone, a message will appear as shown in the picture.

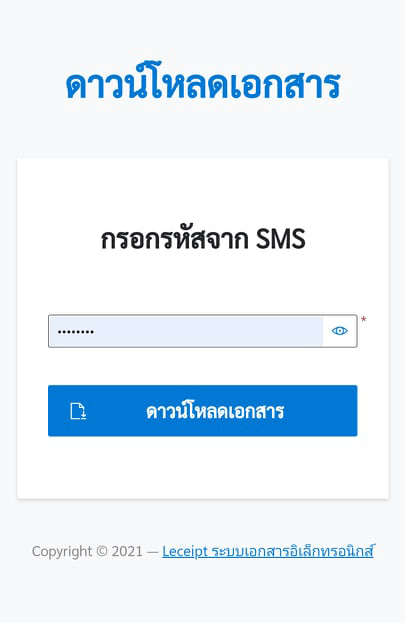

When you click on the link The system will show up as shown in the figure. Then enter the code sent by SMS.

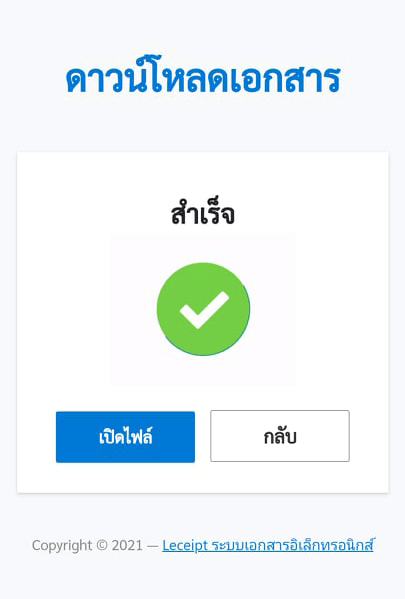

Click the เปิดไฟล์ (Open) button. which should also install an application for opening PDFs (if you don’t have one).

Preview PDF files using the “Adobe Acrobat Reader: PDF Viewer, Editor & Creator” application.

8. PDF file of the completed withholding tax certificate document.

เข้าไปที่ไฟล์เอกสารทั้งหมด แล้วเลือกที่ เอกสาร PDF ซึ่งจะแสดงเอกสาร e-Tax ต่าง ๆ ที่สร้างเสร็จแล้ว ในรูปแบไฟล์ PDF