How to generate an Receipt/Tax Invoice

After signing up and creating your company (seller) information, we will continue to guide you on how to generate the “Receipt/Tax Invoice” with the following steps:

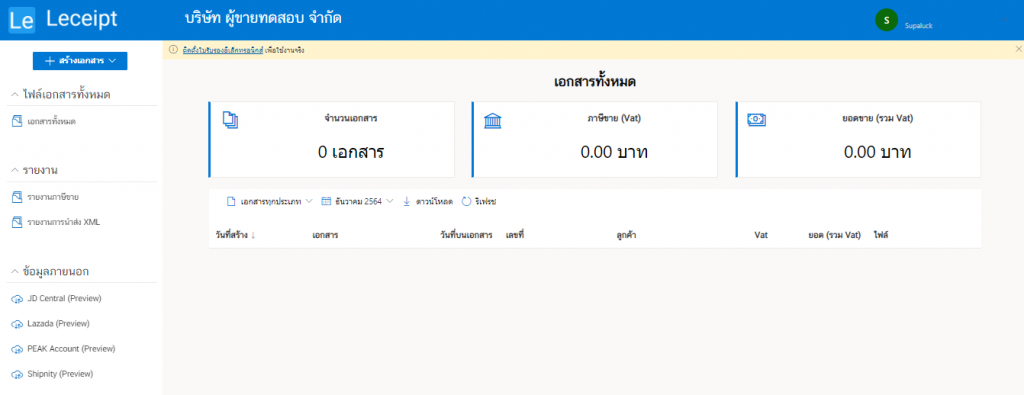

1. Start generate a document.

After registering and creating your seller’s company information, the system will take you to a page that looks like the picture.

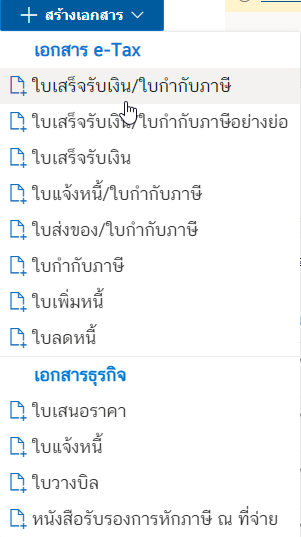

And then choose the ใบเสร็จรับเงิน/ใบกำกับภาษี (Invoice/Receipt)

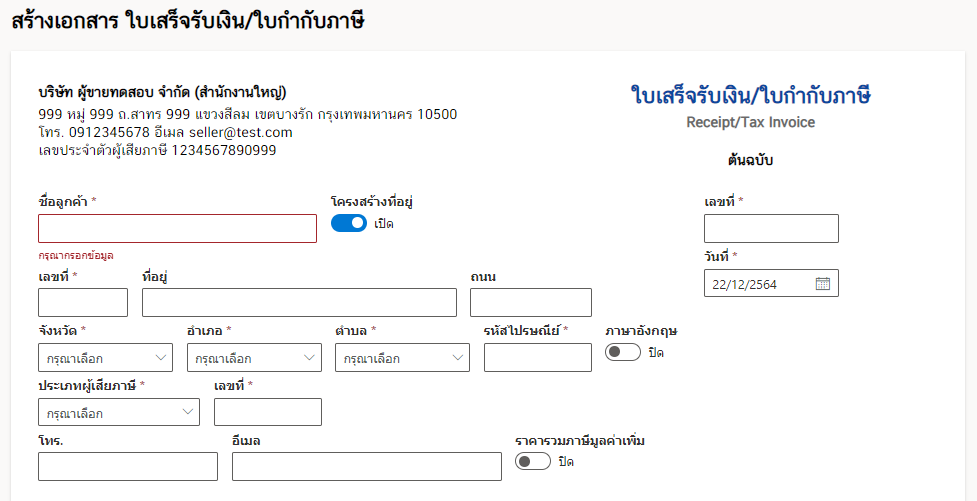

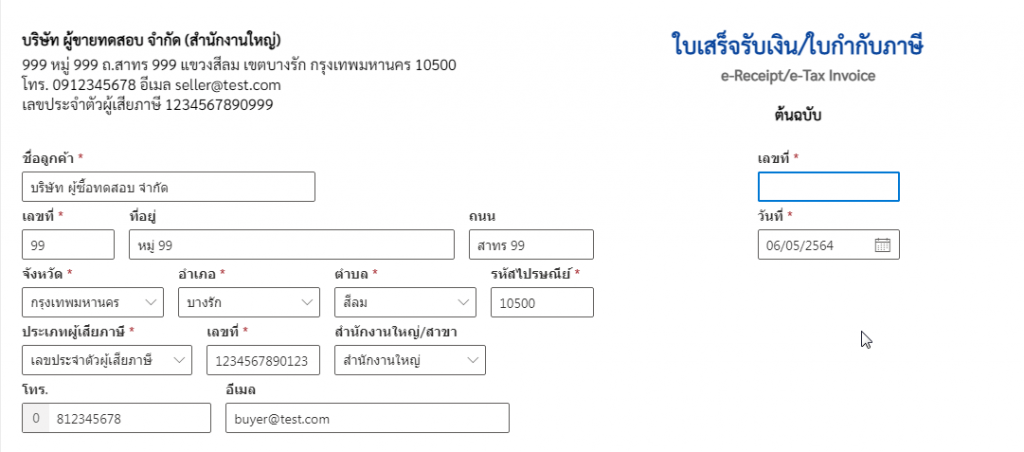

You will see the ใบเสร็จรับเงิน/ใบกำกับภาษี (Invoice/Receipt) form as following.

2. Buyer’s information

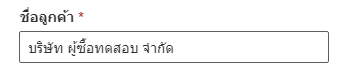

2.1 Enter the name of your client’s company or business for this section. Do not leave blank as in the example image.

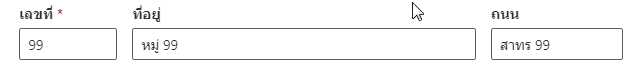

2.2 Entering your customer’s address in the fields, เลขที่ (Number). Enter the location number of the address. (This field cannot be blank), but other address information such as group numbers or village names to be filled in the ที่อยู่ (Address) box. Including the ถนน (Street).

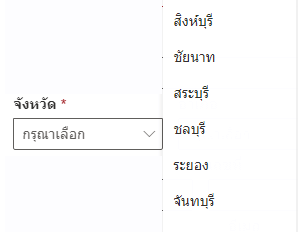

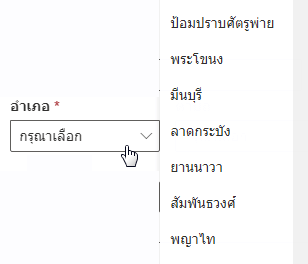

2.3 To input the อำเภอ/เขต (District) this section are mandatory by doing the same after being selected as the preferred province.

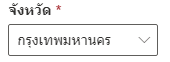

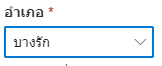

2.4 Choose Bangkok and then you can click to select อำเภอ/เขต (Sub-district).

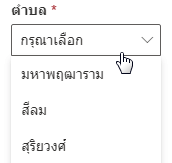

2.5 Then click to select the ตำบล/แขวง (Sub-district).

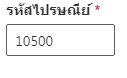

2.6 Entering a postal code can be done as shown below (This section must not be left blank).

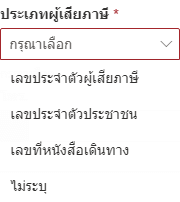

2.7 Enter the types of taxpayers as shown in the picture (this section must not be blank) as shown in the picture.

2.8After that, fill in the 13-digit taxpayer number (this section must not be blank) as shown in the picture.

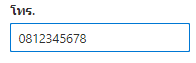

2.9 To enter a phone number, as below.

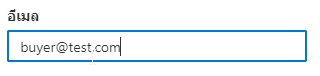

2.10 Enter your customer’s email address as shown in the image.

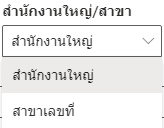

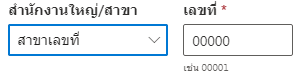

2.11 Then select an office as shown in the picture.

3. Document number and date information

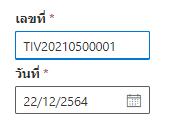

When filling out the address information, from the picture below, you will notice a form to fill in on the right hand side which will have เลขที่ (Number) และ วันที่ (Date).

Entering เลขที่ (Number) which is the document number that you have customized as in the example picture (This section must not be blank) and click to select the desired date.

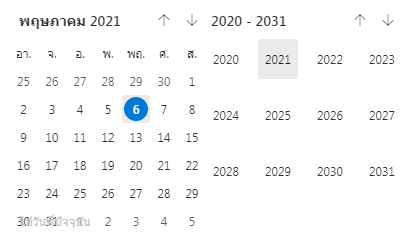

Choose วันที่ (Date)You can click on the form field and you will see a section to select the date. (left hand side) the month part (right hand side) and above is the year. Then click to select as shown in the picture (this section must not be blank).

In order to select the year, you can click on the year’s number area in the picture above, the year’s number will be “2021”. When clicked, it will appear as shown below.

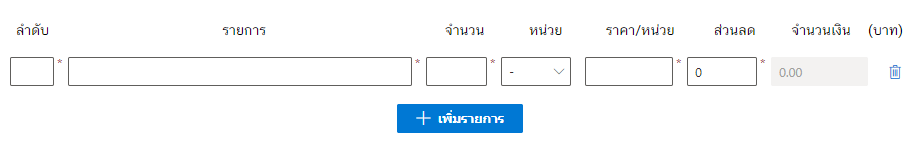

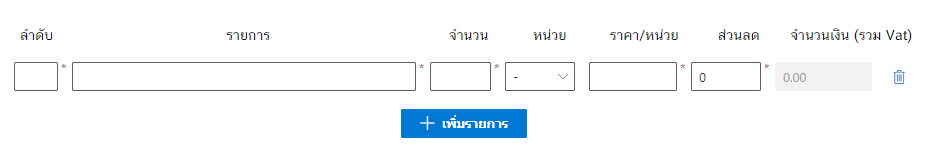

4. Product list and price calculation

Next is the part that fills in information and calculates the products that your customers order as shown in the picture.

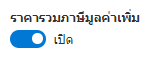

If click รวมภาษีมูลค่าเพิ่ม (VAT) as below.

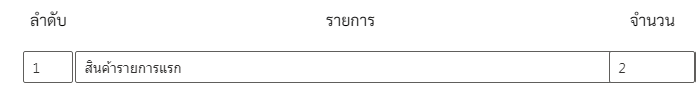

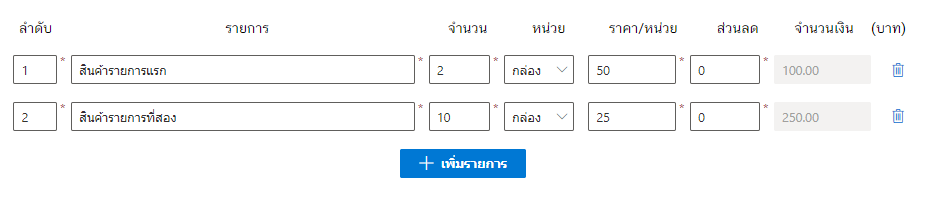

Input the ลำดับ (Number) and fill the รายการสินค้า (price list) and entering the number of products ordered as shown in the picture.

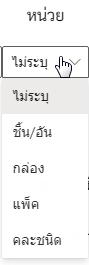

Later to make a choice of หน่วย (Unit of product).

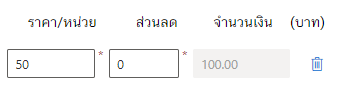

Next, enter the price of the product and try to click on the gray area in the amount section, you will find that the system has calculated the price of the product for you.

To add a product list, press the

เพิ่มรายการ (Add) button.

After adding a product list, it will look like the picture.

For the blue trash can on the far right is a button to delete that item, if you want to delete that product, click on the trash can.

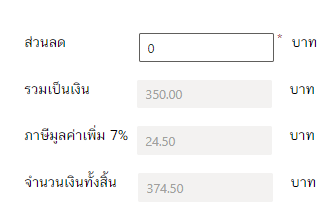

In the lower right corner, you will notice that the system has already calculated the total amount of money.

5. Other information and save data to create document.

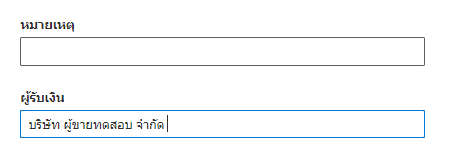

The last part of the form to fill out is below, there will be a note box and the name of the payee, this section can be filled or left blank.

When everything is fine, click the

ต่อไป (Next) button.

Then the system will process the process to wait a moment as shown in the picture.

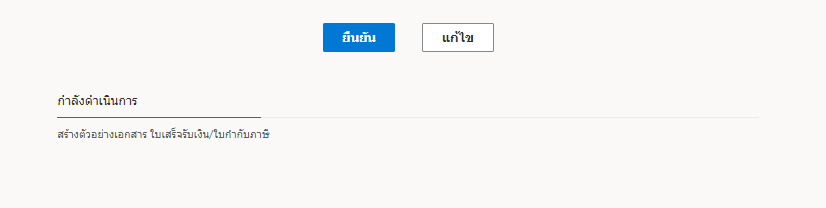

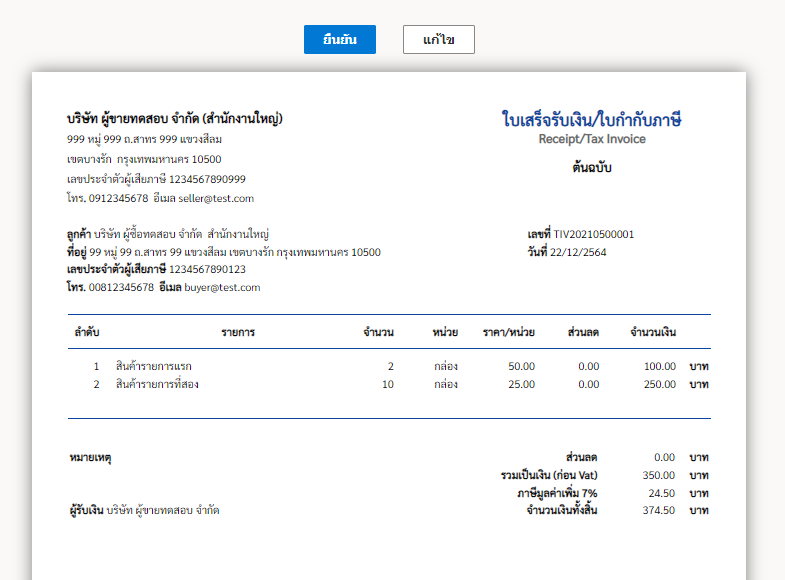

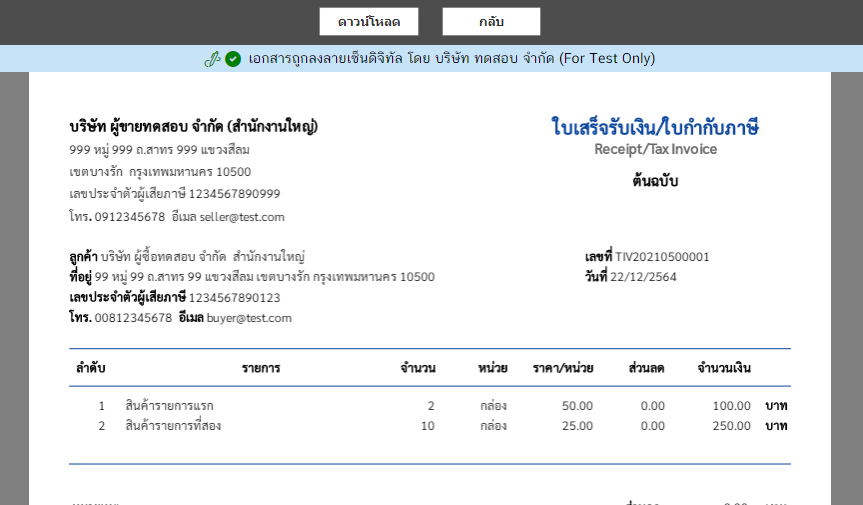

When the system is processed successfully, it will show a preview of the document as shown in the picture. If the displayed data is correct, click the ยืนยัน (Confirm) button. but if you want to edit the document, press the แก้ไข (Edit) button.

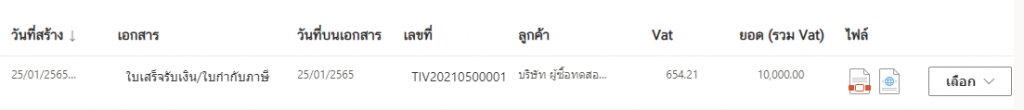

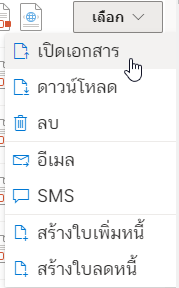

6. Completed Document.

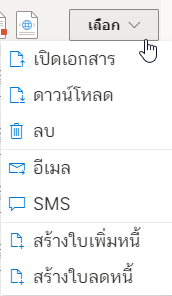

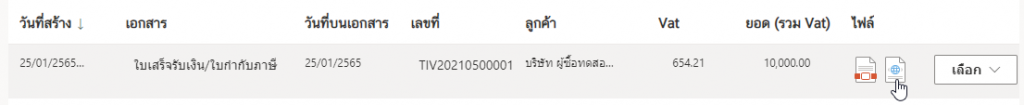

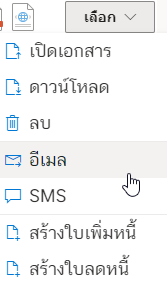

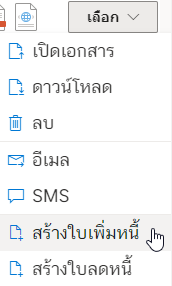

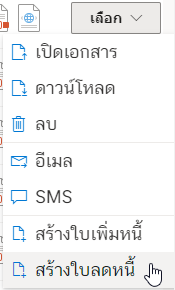

Completed document. It has the following usage patterns:

- Document opening (PDF and XML files supported).

- Download (PDF and XML files supported).

- Emailing (PDF files supported).

- Sending files via SMS (PDF files supported).

- Generate of debit note document (Debit Note).

- Generate of credit note document (Credit Note).

* or “Delete” button in case you want to delete that e-Tax Invoice & e-Receipt document.

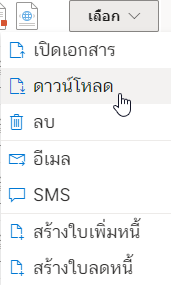

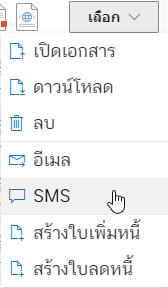

Then click on the เลือก (Select).

7. Openning the document.

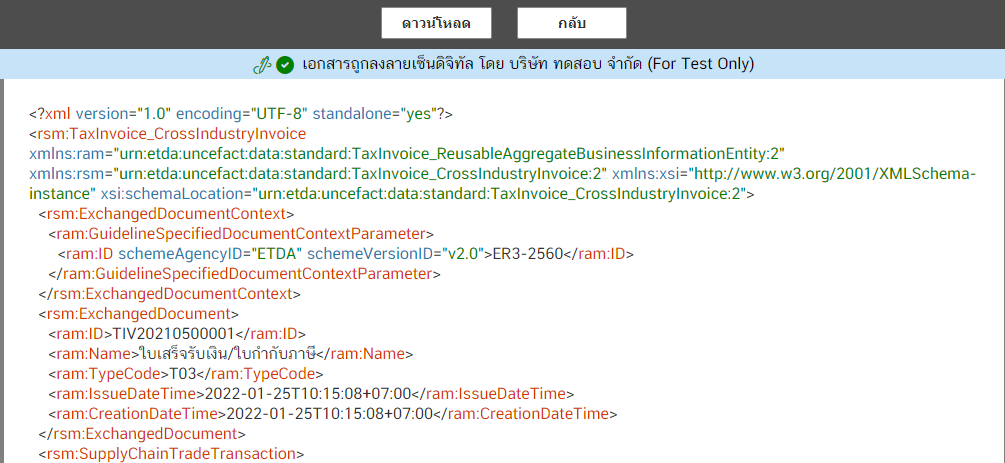

Click on the เลือก (Select). Then click on the เปิดเอกสาร (Open).

In orther way. Notice that the “PDF” icon, click on it (in case of XML in the way).

At “PDF” Icon.

At “XML” Icon

style=”border:1px solid #D3D3D3; border-radius: 0.5rem;” />

style=”border:1px solid #D3D3D3; border-radius: 0.5rem;” />

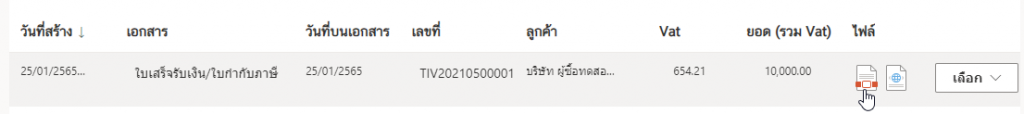

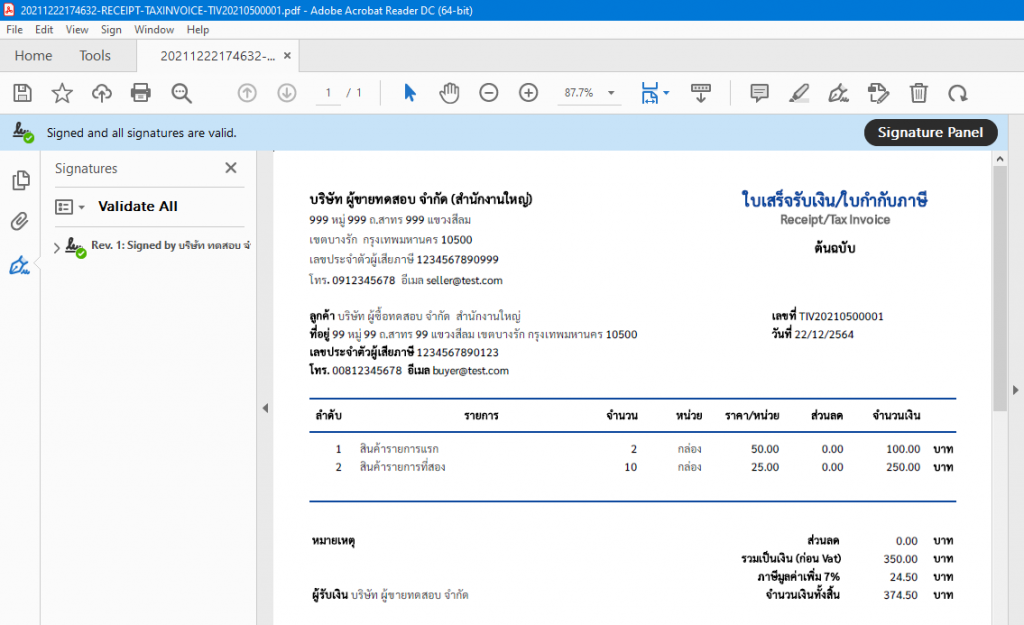

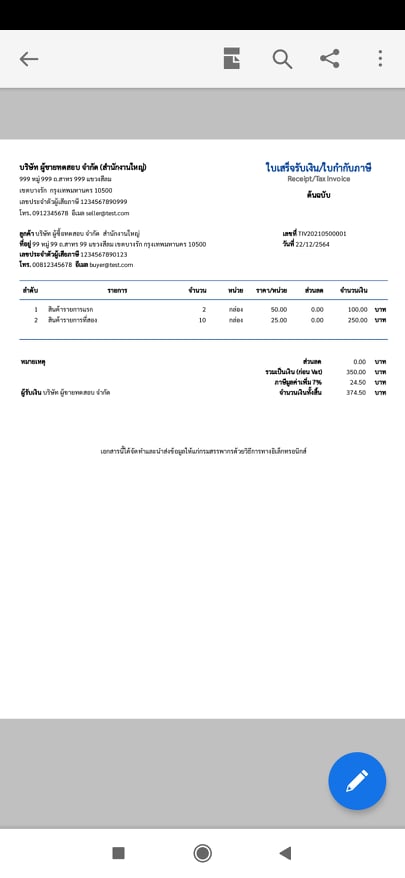

8. Downloading.

Click on ดาวน์โหลด (Download).

And when you open the file (Adobe Acrobat Reader DC is recommended) you’ll see the digitally signed document.

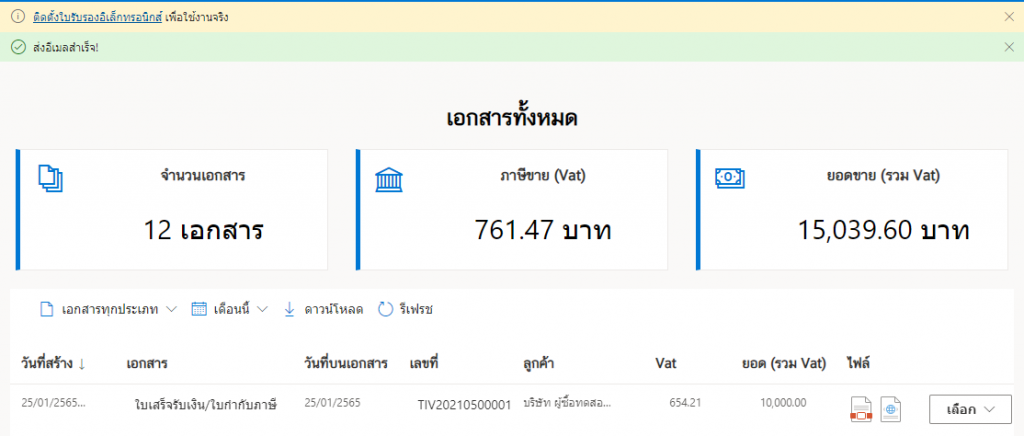

9. Emailing.

Click on the อีเมล (Email).

A pop-up will appear, which can send the document to the desired e-mail address as shown in the picture.

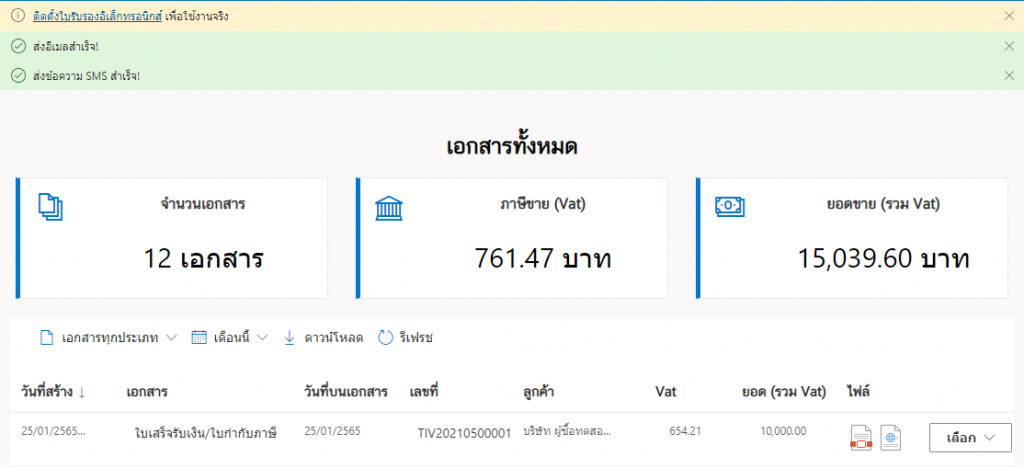

When the file has been sent to the destination email successfully. The system will prompt as ส่งอีเมลสำเร็จ (Email sent!).

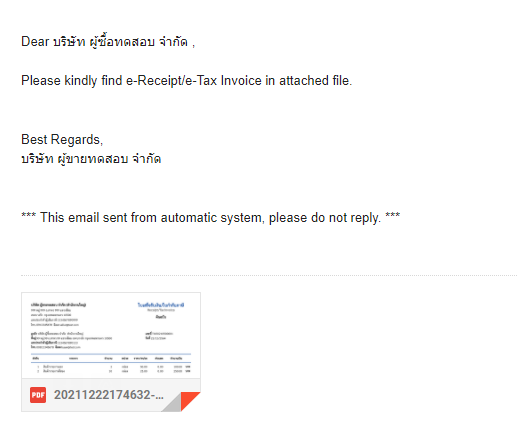

When the recipient has opened the e-mail containing the file will be displayed in the form as shown in the figure.

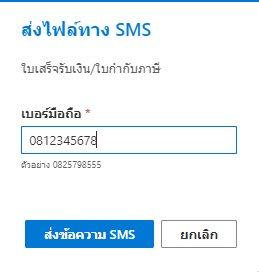

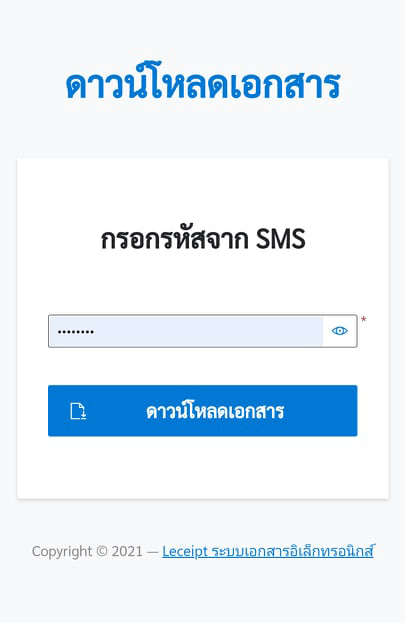

10. Sending SMS.

Our system can also send the file via SMS. By choosing the เลือก (Select) and click on the SMS.

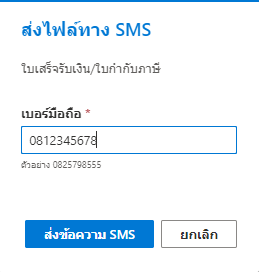

In a pop-up box, enter the email address you want to send the file, And click on ส่งข้อความ SMS (Send SMS).

Once the SMS has been sent successfully, a message will appear ส่งข้อความ SMS สำเร็จ! (The SMS sent!).

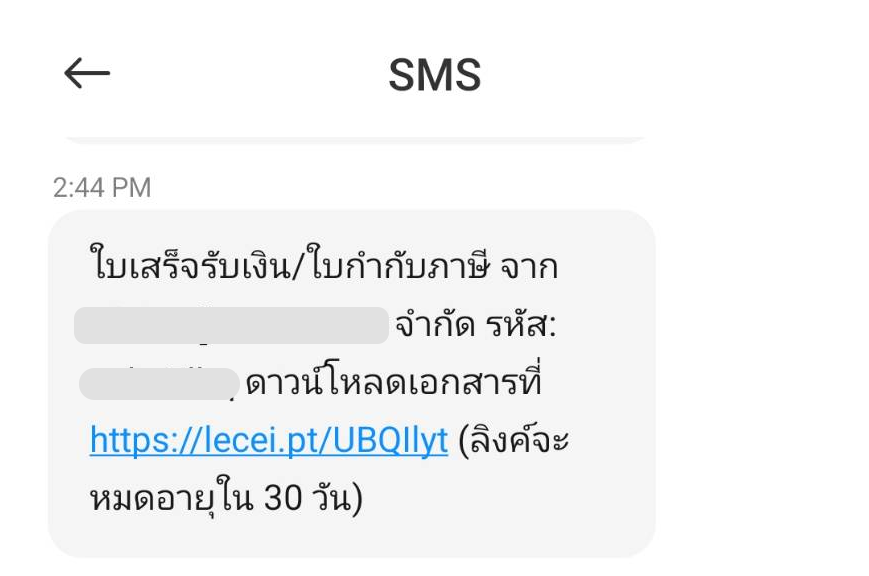

Let’s look at the part of the destination of the person receiving the SMS. When opening the mobile phone, a message will appear as shown in the picture.

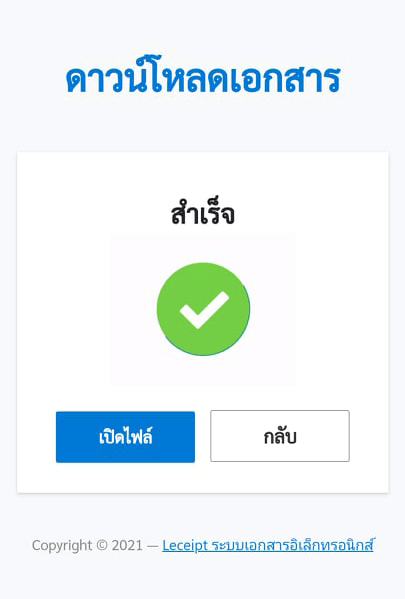

When you click on the link The system will show up as shown in the figure. Then enter the code sent by SMS.

Click the เปิดไฟล์ (Open) button. which should also install an application for opening PDF (if you don’t have one).

Preview PDF files using the “Adobe Acrobat Reader: PDF Viewer, Editor & Creator” application.

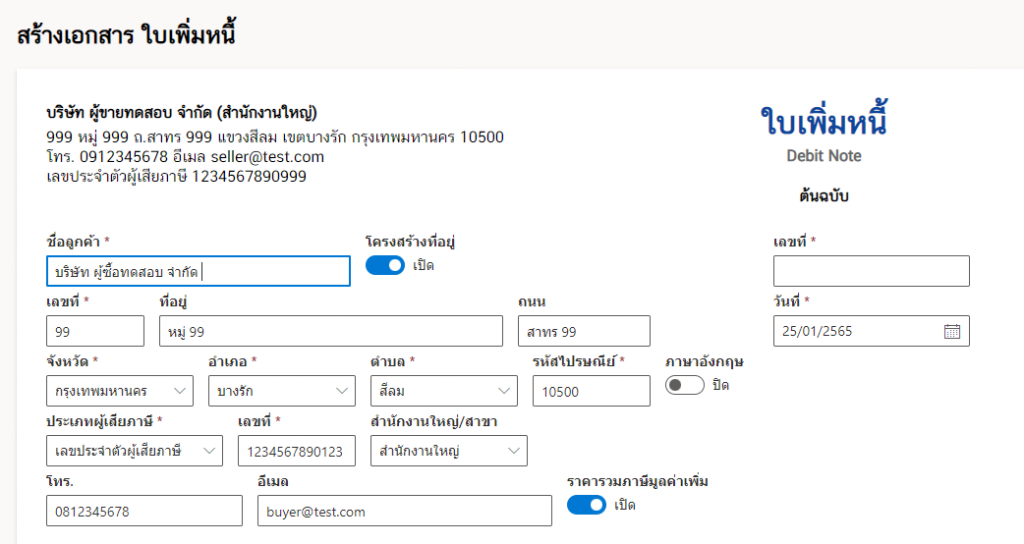

11. Debit note.

Click on the สร้างใบเพิ่มหนี้ (Debit note).

You can fill out the information and generate “Debit note”.

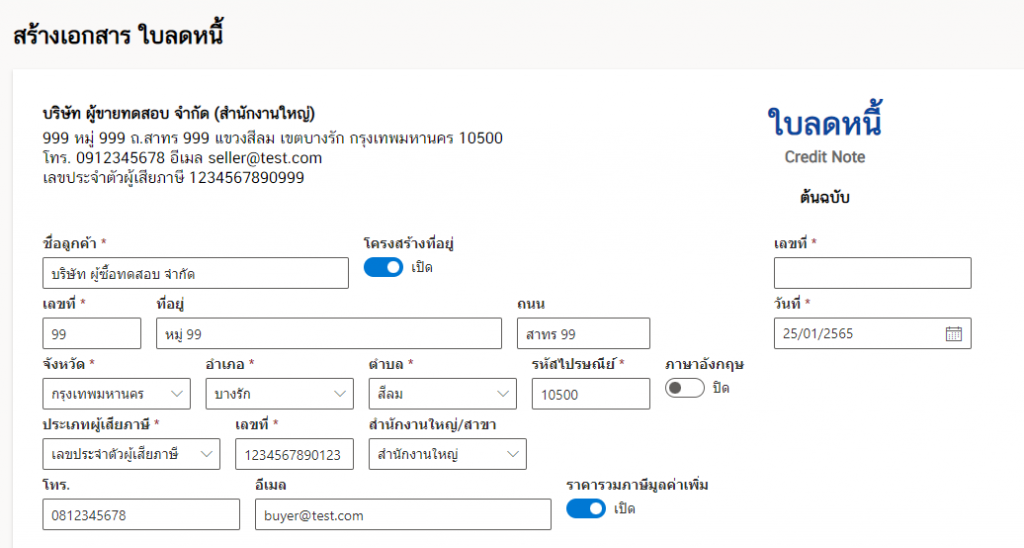

12. Credit note.

Click on สร้างใบลดหนี้ (Credit note).

You can fill out the information and generate “Credit note”.